The spot forex market is a place where people buy and sell different currencies. According to the BIS, as of April 2019, the market was trading over $6.6 trillion every day. This amount includes currency options and futures contracts.

Forex is one of the largest and most liquid financial and trading markets in the world, with billions even trillions of dollars traded daily. However, the market is unregulated and trades instantly, over the counter, with no accountability. This makes it easy for unscrupulous operators to scam people by offering them the lure of earning fortunes in limited amounts of time.

[el_shortcode id=”7102″]

We begin with the term “Is Forex Trading a Scam?” also cover a scam of Forex Trading done with a UK guy and guide you on how to stay away from such scams.

What is Forex Trading?

Forex Trading also called Foreign Exchange (FX) is one of the largest markets of currency exchange and online trading across the world. The trading aims to generate profit from trading in terms of market fluctuations of one currency against another.

It involves the daily transactions of billions of money through online buying and selling currencies. It is not limited to people from across the world but also includes banks, financial institutions, companies, etc.

In other words, it is a process of exchanging two currencies online. For example, if you’re an American visiting India, you’ve sold dollars and bought INR.

How Does Forex Trading Work?

Forex Exchange is the process of involvement of two currencies exchanging online against another currency. The aim is to buy the currencies at lower prices and sell them at higher prices to earn a profit.

The trading starts with buying and selling online currencies. It took place in pairs like one is buying USD ($) against INR (₹). Where the first currency USD ($) in pair is known as the base currency and the second currency is known as the quote currency INR (₹).

So if the USD/INR is trading at $1, this means that $1 is worth ₹83.27. The exchange rate tells you how much of one currency (like the US dollar, or USD) you need to have to get one unit of another currency (like the INR).

If you think the value of the USD is going to increase compared to the INR, you can buy the pair. This is called going long. On the other hand, if you believe the USD will lose value compared to the INR, you can sell the pair, which is known as going short.

How to Start Forex Trading?

The first step is need to start by opening an online brokerage account with an online trading service. In many online trading services, you will even be allowed to create an account with $0. Due to the terms & conditions of the government, some services might require the Know Your Customer (KYC) as one of the steps to verify the user documents.

This helps brokers grasp your comfort level with risk, your understanding of the market, and your overall financial status. It might involve asking you some simple questions about forex and online trading services.

Next, remember about the overnight swap fees. These are charges incurred for maintaining a leveraged position overnight, and they can accumulate to an important amount. Another frequent fee imposed by forex brokers is the inactivity fee, which is levied when an account remains inactive for a certain duration.

Before going live in trading, some trading services will even provide you with a demo of a real-life situation of trading including all parameters considered in live trading.

Note: It is recommended before starting to trade online, you should take advice from your broker, and online tools such as websites, and Google, and connect with a knowledgeable person you can also gain knowledge through some trading websites providing videos and tutorials.

Also Read:

Exposed: The 12 Scam Numbers You Should Never Answer

Advantages and Disadvantages of Forex Trading?

Advantages

24/7 access: Forex trading accounts can easily be set up online within a few seconds and can be funded with a minimum of $100. Given that it’s a true 24/7 market, traders have the flexibility to enter and exit positions at any hour of the day or night.

Charges: Given that the forex market operates in a decentralized manner, it doesn’t involve any exchange or clearing fees. Usually, the expenses associated with initiating a trade are incorporated into the spread. However, if you’re trading with an ECN (Electronic Communications Network) broker, there’s an extra commission to consider.

Leverage: The foreign exchange market allows you to borrow a lot more than your actual investment. This is usually seen as a good thing. However, it’s important to remember that while this can increase your profits, it can also increase your losses. So, it’s not always beneficial for the trader.

Disadvantages

Interest conflict: Forex brokers who are market makers or dealing desks automatically bet against a client’s trade. So, if a client loses money, they make money. This creates a potential conflict of interest.

Dividends: Forex traders can make money from the difference in interest rates between two currencies. This is done using a strategy called the Carry Trade. The idea is to buy a currency pair where the first currency has a high-interest rate and the second one has a low rate. By doing this, the trader can earn money from the difference in interest rates.

Is Forex Trading Legal?

Forex trading is a legal and valid way to trade. However, because the market is decentralized and often not well-regulated, it’s known for scams. So, when choosing a broker, people need to be aware of such tasks that can lead them to a scam like software that promises fast money.

Is Forex Trading a Scam?

Forex trading is not fraudulent in itself, but some fraudsters exploit this field to deceive unsuspecting investors. These scams can take various shapes, ranging from dishonest brokers to counterfeit trading systems.

How does Forex Trading Scam Work?

Forex scams usually attract people with the false promise of huge profits with no risk. Fraudsters put pressure to convince investors to put a lot of money into a trading account, assuring them that these funds will be used to earn more profits. But once the money is deposited, the fraudsters cheat, leaving the investor with nothing.

What is the proof of the Forex Trading Scam?

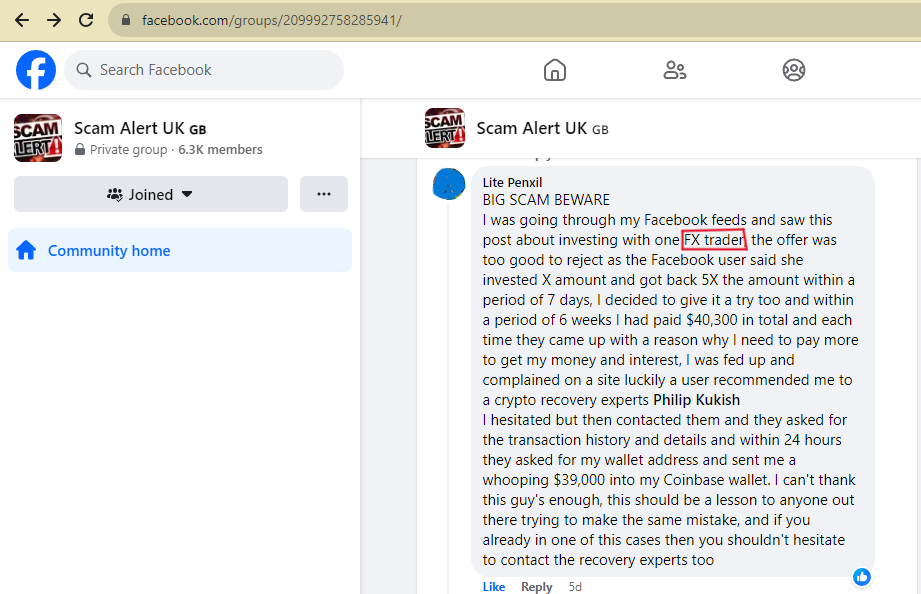

Recently, a week ago a FB user from the UK his name is Lite Penxil, was scammed through Facebook Feeds ads of FX Trader. He saw an offer that one of the FB users told that she invested X amount and got returned 5X within a week. Penxil, was unable to stop himself from investing in trading after seeing this ad. Finally, Penxil invested a total amount of $40,300 within 6 days, but later Penxil got doubt and complained on a site, he was referred by somebody to ensure him that a person named Philip Kukish, would help you (Penxil) to get your money back.

Penxil, at first hesitated but later he shared every detail (transaction history, wallet address) with Kukish, to help him recover the funds. Finally, he got back $39,000 into his Coinbase wallet.

Here’s the proof of the scam of Penxil, a FB group named “Scam Alert UK”, where Penxil informed the group to warn others about the scam on behalf of FX Trading.

What are the types of Scams run on behalf of Forex Trading?

Ponzi Schemes: This kind of fraud assures you’ll make a lot of money without any danger. They guarantee you’ll get your initial investment back, along with some extra earnings. However, instead of using your money for business, the fraudster uses the money from new investors to pay the old ones.

Phony Investment Advisors: In this kind of fraud, a person pretends to be a financial advisor and persuades people to invest in foreign exchange trading, but they don’t reveal their financial gains from it.

Unregistered Firms: This kind of fraud is when a company that isn’t officially registered offers foreign exchange trading services without having the necessary legal permissions or following the rules.

High-Pressure Sales Tactics: This kind of fraud uses intense persuasion methods to make investors quickly put in a lot of money.

Refusing to Withdraw Funds: This scam is when a fraudster won’t give back an investor’s money, or makes it hard for the investor to take out their money.

Automated Trading Systems: This scam is when a computerized trading system promises to make money, but actually, it’s a system that loses money.

Also Read:

Phishing Scam Alert: What to Do with Suspicious USPS Emails

Conclusion: Forex Trading Scam is Over

Scammers are everywhere in the world and have been scamming people in the best possible ways in various forms whether it is online e-commerce websites or online trading. It is recommended to stay alert from such scams especially when you’re going to invest your hard-earning money. Always get help from a knowledgeable person and a verified broker before investing.

FAQs

What is Forex Trading?

Forex Trading is the process of exchanging two currencies on based of exchange rate. It considers buying and selling online currencies from one person to another. The exchange is done to make a profit.

Is Forex Trading Legal?

Forex trading is a legal and valid way to trade. However, because the market is decentralized and often not well-regulated, it’s known for scams. So, when choosing a broker, people need to be aware of such tasks that can lead them to a scam like software that promises fast money.

Is Forex Trading a Scam?

Forex trading is not fraudulent in itself, but some fraudsters exploit this field to deceive unsuspecting investors. These scams can take various shapes, ranging from dishonest brokers to counterfeit trading systems.

How does Forex Trading Scam Work?

Forex scams often lure people by making them believe they can make a lot of money without any risk. The scammers push people to invest a lot of money, promising that this money will be used to make even more money. But as soon as the money is put in, the scammers trick them and take everything, leaving the person with nothing.

How to Spot a Forex Scam?

Wide Bid-Ask Spreads: Be alert and cross-check if forex brokers giving wide bid-ask spreads on certain currency pairs, making it more difficult to earn profits on trades.

Unregulated Brokers: Be careful with the terms & conditions, of unregulated brokers. Make sure there are no complaints related to services, and read through all the fine print on documents.

Signal Sellers: Signal sellers are firms that offer a system based on a charge for a day, week, and month that claims to identify favorable times to buy or sell a currency pair.

Robot Scams: Be especially wary of software that claims to have found a ‘secret formula’.

Too Good to Be True: If something sounds too good to be true, it probably is.

What are the questions should ask to avoid a Forex Trading Scam?

- Is the broker regulated?

- If regulated, how trustworthy is the regulatory body?

- How do I know what regulators are legitimate?

- Is the broker offering profits or rewards for opening an account?

- Is the broker offering a cash bonus for opening an account?

- Is the broker offering automatic trades or signals to guarantee profits?

- Is there any credible information about the company on its official website, such as its history, financials, or headquarters address?

How can I avoid Forex scams?

Promises of High Returns: Be aware of false promises of high returns. Forex trading holds inherent risks, and no broker can guarantee consistent profits.

Unsolicited Calls and Emails: Always stay alert from unknown calls and emails offering a scheme of high return on a small amount of investment.

Hidden Fees: Check for hidden fees.

Unregulated Brokers: Avoid unregulated brokers.

Reputable Payment Methods: Use reputable payment methods.

Demo Account: Always go with a demo account before investing your money in live trading.

Expert Advisors: Stay Alert from expensive Expert Advisors as they can try to manipulate. Go with customer reviews and focus on negative reviews to catch their weaknesses.

Fraudulent Finfluencers: Be aware of scammers and financial influencers, especially those promoting Forex Trading Scam schemes.

[el_shortcode id=”7108″]